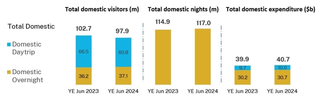

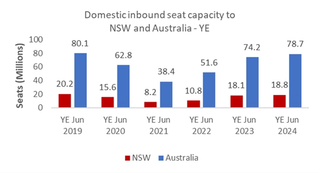

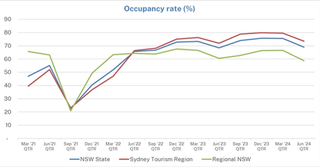

The visitor economy in NSW and Australia continues to recover from the impact of COVID-19, while also weathering the cost-of-living crisis. Although overall visitor numbers in FY23–24 dropped in NSW (compared to FY22–23) due to a sharp decline in domestic day trips and had yet to reach pre-pandemic levels, visitor nights and expenditure showed improvement. These results surpassed both the prior year and pre-pandemic levels. In FY23–24, NSW recorded its highest total visitor expenditure on record since 1998.

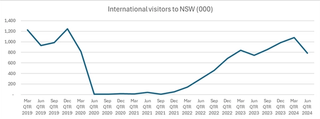

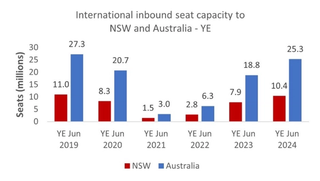

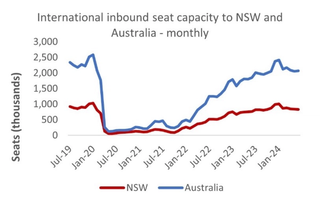

Overall, NSW received 101.6 million total visitors, down 3.6 percent from FY22–23. These visitors stayed 216 million nights (up 18.3 percent) and spent $52.9 billion (up 9 percent from the previous year). Over the past 12 months, international visitors increased by 35.6 percent and domestic overnight visitors by 2.6 percent, though domestic day trips fell by 8.7 percent year-on-year.

Compared to the pre-COVID-19 period, international visitors to NSW were down by 0.7 million, domestic overnight visitors by 0.1 million, and domestic day trip visitors by 8.4 million. On a positive note, all three visitor types saw expenditure above pre-pandemic levels, with both domestic and international nights surpassing FY18–19 levels.

Domestic day trip visitors accounted for 60 percent of all visitors to NSW and 19 percent of expenditure in FY23–24. NSW’s domestic overnight visitor share was 37 percent, contributing 58 percent of the state’s visitor expenditure. International visitors made up only 4 percent of total visitation but accounted for 23 percent of expenditure.